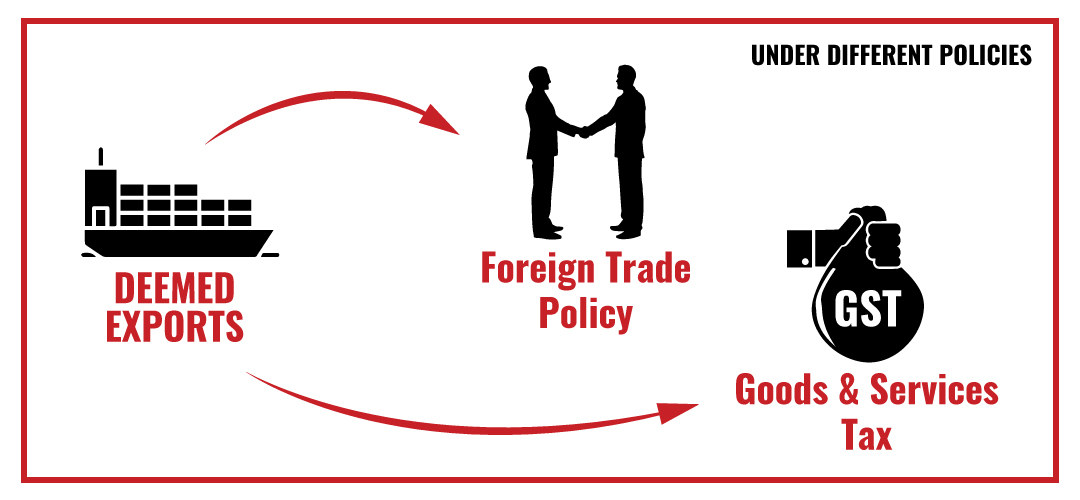

Deemed exports are the ones which do not qualify the definition of physical exports as described by the Government of India under the Foreign Trade Policy.

The goods/products/services do not leave the country and payments are received either in Indian rupees or in free foreign exchange.

Before classification, let’s understand the concept and the premise behind Deemed exports with the help of a short example-

An exporter of fine jewellery makes $500,000 of foreign exchange by exporting jewellery items to USA and Canada. Now, he uses precise instruments manufactured and designed by some Indian manufacturer. The manufacturer is upset that the exporter is getting all the incentives and appreciation by the government while he is getting nothing and so, he asks the government to recognize and value his contribution in providing foreign currency to the govt by aiding the jeweller and by reducing the cost of local purchase of precise instruments from domestic manufacturer. To value the contributions of such manufacturers and organizations, the concept of Deemed exports was introduced.

# Deemed export under Foreign Trade Policy

The supply of goods under Deemed exports in FTP should lie under 2 broad categories*:

Manufacturer which is further divided into 4 broad sub-categories*:

- Supply of goods under Advance Authorization, DFIA

- Supply of goods to EOU, STP, BTP

- Supply of capital goods under EPCG

- Supply of Marine freight containers by 100% of EOU

Main/Sub-contractors which is also divided into 4 broad sub-categories* :

- Supply of goods financed by multilateral or bilateral agencies

- Supply and installation of goods to projects financed as mentioned above and for building mega power plant

- Supply of goods to UN or other international agencies

- Supply to nuclear power plants

* Refer to Chapter 7 of FTP for detailed list of categories

Customs duty or Terminal excise duty benefits can be availed for aforementioned categories of deemed export.

# Deemed export under GST

The categories specified for entitlement of Deemed export benefit under GST are :

- Supply of goods by a registered person against Advance Authorisation

- Supply of capital goods under EPCG scheme

- Supply to an EOU unit

- Supply of gold by a bank or Public Sector Undertaking.

Only the above supplies are entitled for GST benefits, some of them are also entitled for other benefits under the FTP.

GST refunds can be claimed for above categories of Deemed exports.

Recommendations (For a supplier / customer)

If you are supplying or purchasing raw-material/semi-finished goods / capital goods to any manufacturer/trader in domestic markets, do not miss out on evaluating above benefits. There is a good possibility, of exploring one of above benefit and thereby you can surely reduce your cost and be competitive even in domestic market.

Time and again, it has been observed that not all companies are optimizing taxes involved in supply chain and making the most of deemed export benefits. That is why are miles away from becoming Atmanirbhar bharat.

We would be happy to support all the stakeholders in achieving the dream of becoming #Atmanirbhar bharat. Jai Hind! Jai Bharat!

Contact us via e-mail / phone call, we will get back to you in short time. We provide services for Import Export Incentives, Import Export Legal Services, EXIM Training, EXIM Compliance.

Follow us for more content on trade and foreign policies. We are on Facebook, Twitter and LinkedIn as Bizbrains Advisors.

For any queries and assistance on Deemed exports or any EXIM scheme and procedure of application contact us at:

One Response

In Deemed exports, wherever you have referred as ‘supply to EoU Unit’, can we considee ‘supply to SEZ’ also?

If I am getting an equipment in my SEZ, which is sources from DTA. Should I go for special Brand Rate Fixation to claim drawback?

Do I have to make the payment to that DTA suppler through my FCA essentially?

Kindly throw a light.

Thanks