SEZ are special zones to promote exports & create economic growth. Did you know the first Special Economic Zone (earlier known as EPZ) of Asia was set up in 1965 in Kandla, Gujarat with a view to promote exports?

As Part of Back to Basics – Let’s Explore more about Special Economic Zone, learn SEZ objectives, characteristics and benefits with application process.

How SEZ Started?

In today’s blog article, we will talk about the least discussed and underrated the topic SEZ (Special Economic Zone).

Did you know the first SEZ (earlier known as EPZ) of Asia was set up in 1965 in Kandla, Gujarat with a view to promote exports? Later EPZ got modified to become Special Economic Zone , in the year 2005, with a view not to just promote exports but also other economic activities.

SEZ Objectives

- To serve as growth engines to increase manufacturing in India and exports from India: Special Economic Zone provides incentives to both foreign as well as Indian companies by supporting easy compliance in labour laws, decrease in red tapes for industries, free import of raw materials for manufacturing and export and zero excise tax.

- To attract the foreign companies to invest in our country.

- To develop infrastructure: As industrialisation would increase, the income of the population would increase leading to the development of better roads, better housing facilities, modes of transport etc.

- To foster employment: given the industries would increase, the employment shall increase.

- Special Economic Zone also promote export of services which was not in the case of EPZ.

- In a way, Special Economic Zone are being established to promote both manufacturing and service sectors in India.

SEZ Characteristics

- It is a deemed foreign area.

- Special Economic Zone can be established by both government as well as private entities.

- No duties on import*.

- No customs or tariffs on export*.

- There are special types of Special Economic Zone as well: Reverse SEZ and Finance SEZ

- Special Economic Zone is also available for opening of Off-shore Banking Units (OBU).

*Export and import here also refer to other SEZ and DTA (Domestic Tariff Area, which is all the area in the country except the Special Economic Zone itself)

Export / Import under SEZ

Coverage of the scheme or who are eligible for the scheme:

- Special Economic Zone units may export goods and services including agro products, partly processed goods, sub-assemblies and components except prohibited items of exports in ITC (HS). The units may also export by-products, rejects, waste scrap arising out of the production process. Export of Special Chemicals, Organisms, Materials, Equipment and Technologies (SCOMET) shall be subject to fulfillment of the conditions indicated in the ITC (HS) Classification of Export and Import Items.

Special Economic Zone units, other than trading/service unit, may also export to Russian Federation in Indian Rupees against repayment of State Credit/Escrow Rupee Account of the buyer, subject to RBI clearance, if any. - SEZ unit may import/procure from the DTA without payment of duty all types of goods and services, including capital goods, whether new or second hand, required by it for its activities or in connection therewith, provided they are not prohibited items of imports in the ITC(HS). However, any permission required for import under any other law shall be applicable. Goods shall include raw material for making capital goods for use within the unit. The units shall also be permitted to import goods required for the approved activity, including capital goods, free of cost or on loan from clients.

- SEZ units may procure goods required by it without payment of duty, from bonded warehouses in the DTA set up under the Policy and/or under Section 65 of the Customs Act and from International Exhibitions held in India.

- SEZ units, may import/procure from DTA, without payment of duty, all types of goods for creating a central facility for use by units in SEZ. The Central facility for software development can also be accessed by units in the DTA for export of software.

- Gem & Jewellery units may also source gold/ silver/ platinum through the nominated agencies.

- SEZ units may import/procure goods and services from DTA without payment of duty for setting up, operation and maintenance of units in the Zone.

SEZ Effects

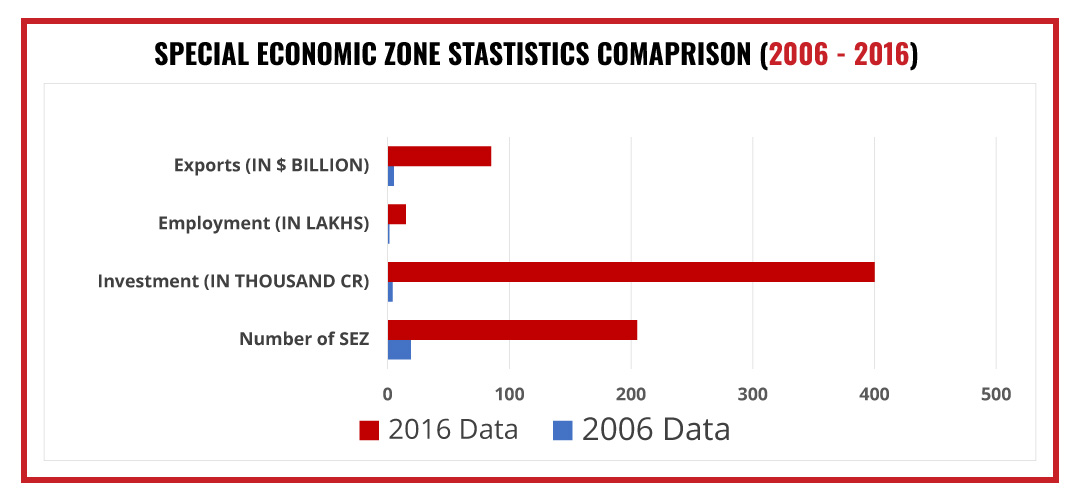

With SEZ in effect, economies thrive in different way. Let’s look at some insights how India has achieved it’s export success over the years.

From above statistics we can see that from 2006 to 2016, nearly in a decade, number of SEZ increased from 19 to 205, resulting in Investment from 4000 Cr. INR to 4 Lakhs Cr., employment increased from 1.3 lakhs to 15 lakhs, ultimately totaling exports from 5 billion USD to 85 billion USD.

So, there has been an increase of 9900% in investment and 1600% increase in exports through SEZ in just 10 years. As mentioned above, SEZ can be set up by government private or foreign entities.

Exceptions provided to SEZ developers

Export obligation: the one who imports goods under the EPCG scheme should fulfill an export obligation equivalent to 6 times the amount saved due to the scheme.

Let’s look what comes under the umbrella of Export Obligation:

- Payment of Customs duty for goods or services imported into SEZ for its operations and goods exported or services provided from SEZ outside India.

- Payment of Excise duty for goods brought from Domestic Tariff Area to SEZ for its authorized operations.

- Provided the SEZ is operationalized by 31.03.2017, developers are exempted from payment from Income Tax under the Income Tax Act as per rules in force, as follow:

Income Tax exemption for a block of 10 years in 15 years under Section 80-IAB of the Income Tax Act. Block of 10 years will be selected at the discretion of the developer

- Payment of Central Sales Tax for its authorized operations.

- Payment of Service Tax under Chapter V of the Finance Act 1994 on taxable services consumed for its authorized operation.

Exemption in SEZ units in the purview of the economic activities done within it –

- Payment of customs duty for goods or services imported into SEZ for its operations and goods exported or services provided from SEZ outside India.

- Payment of Excise duty for goods brought from Domestic Tariff Area to SEZ for its authorized operations provided that the unit commences commercial operations by 31.03.2020,

- SEZ Units are exempted from payment from Income Tax and other taxes under the Income Tax Act as per rules in force, as follows

100% Income Tax exemption for SEZ units under Section 10AA of the Income Tax Act for first 5 years, 50% for next 5 years thereafter and 50% of the ploughed back export profit for next 5 years. Income tax benefit as mentioned above is available on the profits out of exports made out of India.

How to Apply for the opening / establishing of an SEZ unit?

A Multi Product SEZ shall have a contiguous area of five hundred hectares or more but not exceeding 5000 hectares. Provided that in case a Special Economic Zone is proposed to be set up in Assam, Meghalaya, Nagaland, Arunachal Pradesh, Mizoram, Manipur, Tripura, Himachal Pradesh, Uttaranchal, Sikkim, Jammu and Kashmir, Goa or in a Union Territory, the area shall be one hundred hectares or more.

Conditions include :

- Provided further that at least fifty per cent of the area shall be earmarked for developing the processing area

- Provided also that the Central Government may consider on merit the clubbing of contiguous existing notified Special Economic Zones notwithstanding that the total area of resultant Special Economic Zones exceeds 5000 hectares.

- A Special Economic Zone for a specific sector or [for one or more services] or in a port or airport, shall have a contiguous area of fifty hectares or more.

How to Open a unit within a SEZ ?

For setting up a manufacturing, trading or service units in Special Economic Zone, application, along with project report and required documents shall be submitted to the Development Commissioner of the Special Economic Zone concerned which will be then be placed before the Unit Approval Committee for consideration. UAC will consider all applications for setting up a unit except those falling under the purview of the Board of Approvals.

Other Articles that might Interest you that helps sustain businesses :

- Know more about upcoming RoDTEP : RoDTEP just 3 months away – Are you Ready?

- All about EPCG – Export Promotion of Capital Goods

- Special Economic Zone with Bonded Warehouse – A Game Changer for the manufacturing sector

Special Economic Zone are gateways for exporters to connect with worldwide trading. there are so many incentives & business optimizations to help businesses grow in this cutthroat economic conditions. Mid size units should look into it & take necessary steps to avail such benefits. Bizbrains help such businesses grow & optimize their exports & reduce costs.

For more content and updates follow us on LinkedIn, Twitter and Facebook; our handle is Bizbrains Advisors. Get a heads up on various schemes on export-import activity and let us know your thoughts in comment section!

One Response