Bonded Warehouse Scheme, provides mechanism to store dutiable goods in secured area without payment of duty while they are stores, manipulated or undergo manufacturing operations. These warehouses can be managed by state or private enterprises.

In this Article, Let’s Explore more about Bonded Warehouse Scheme.

In our blog Bonded Warehouse – A Game Changer for the manufacturing sector, we covered most of the aspects of bonded warehouse along with its relevance when compared to other existing schemes.

Today, we will be looking at some salient features and some Frequently Asked Questions (FAQ).

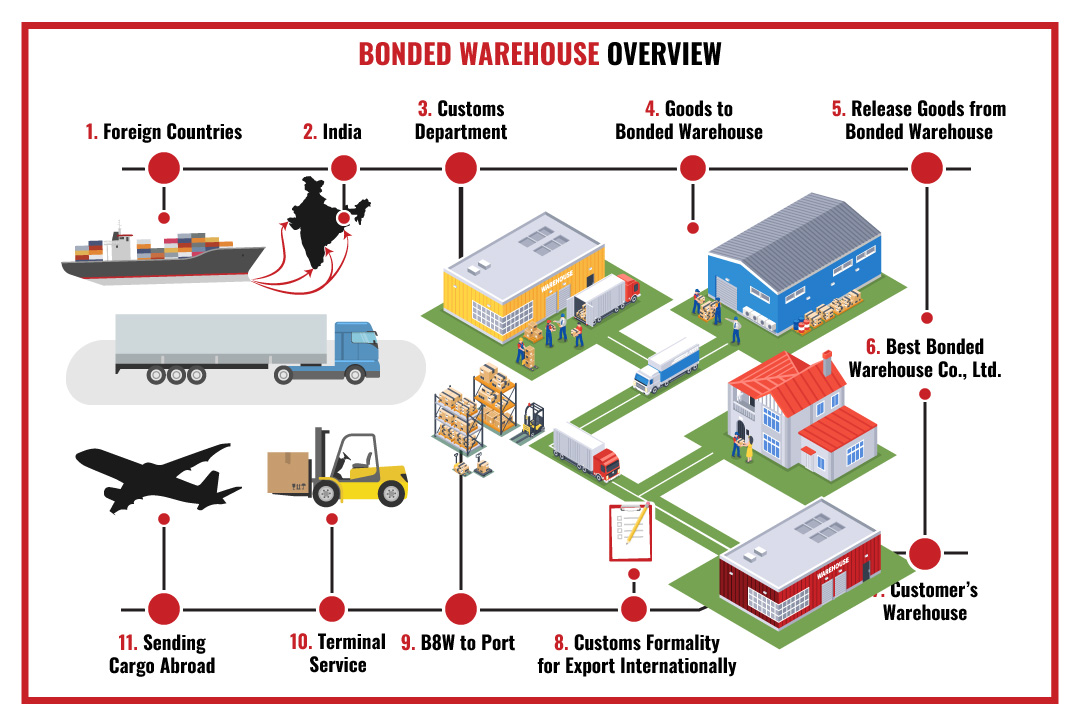

Overview of the Bonded Warehouse scheme

The Central Board of Indirect Taxes and Customs (CBIC) have launched a revamped and streamlined program to attract investments into India and strengthen Make in India and this program is based upon Section 65 of the Customs Act, 1962, which enables conduct of manufacture and other operations in a Customs bonded warehouse. The program has been introduced vide the Manufacture and Other Operations in Warehouse (no. 2) Regulations, 2019, (MOOWR, 2019) and explained through Circular-34/2019- Customs dated 01st October, 2019.

Customs Bonded Manufacturing Warehouse is a secured and customs licensed area/structure. At these warehouses the imported inputs, consumables, or capital goods are stored which can be used for manufacturing and further supply in indigenous and international market where the customs duty on such import is deferred.

Salient features of Bonded Warehouse Scheme

- No geographical limitation on where such units can be set up.

- A single application cum approval form for uniformity of practice with a single point of approval to set up the operations of such units.

- Improved liquidity with deferment of import duty and no interest liability.

- Allows procurement of GST compliant goods from the domestic market for use in manufacture and other operations in a Section 65 unit.

- A single digital account for ease of doing business and easy compliance.

- Enables efficient capacity utilization, as there is no limit on quantum of clearances that can be exported or cleared to the domestic market.

Bonded Warehouse Process

So, How Bonded Warehouse can be used?

Kempegowda International Airport, Bangalore, has recently opened India’s first on-airport public bonded warehouse. The warehouse is expected to reduce supply chain costs and facilitate trade in and around Bengaluru. The facility — covering an area of 10,000 square feet — is expected to help re-export of goods, in long-term storage of bonded cargo, to assist in partial clearances, and to allow labeling, packing, and repacking services.

In order to simplify processes and meet customer demands with the help of key stakeholders, including the Bengaluru Customs, BIAL has taken this step to set up India’s first on-campus Public Bonded Warehouse. While the warehouse facility will be under the jurisdiction of the City Commissionerate, of Bengaluru Customs. It is also regarded to reduce supply chain costs and facilitate trade at India’s IT hub and surrounding regions. With IT & Biotechnology (BT) companies, multinational firms, and retail brands in Bengaluru handling a large volume of imports, experts add that the new facility will play a significant role in boosting the economy of the region. Bengaluru Airport is also regarded as the busiest cargo terminal for manufacturers in South India.

Frequently Asked Questions about Bonded Warehouse

The following persons are eligible to apply for manufacture and other

operations in a bonded warehouse,

(i) A person who has been granted a licence for a warehouse under Section 58 of the Customs Act, in accordance with Private Warehouse Licensing Regulations, 2016.

(ii) A person can also make a combined application for licence for a warehouse under Section 58, along with permission for undertaking manufacturing or other operations in the warehouse under Section 65 of the Act. The persons mentioned have to be a citizen of India or an entity incorporated or registered in India.

The eligibility of a factory for manufacture and other operations in a bonded warehouse does not depend upon whether the final goods will be sold in the domestic market or exported. There is no quantitative restriction on sale of finished goods in the domestic market. Any factory can avail a license under Section 58 of the Customs Act along with a permission under Section 65 if they intend to import goods without upfront payment of Customs duty at point of import and deposit them in the warehouse, either as capital goods or as inputs for further processing.

Yes. Any unit in Domestic Tariff Area (DTA) is eligible for making an application for manufacture and other operations in a bonded warehouse i.e. an old factory in DTA is eligible for applying. The accounting form prescribed for the units undertaking manufacture and other operations in a bonded warehouse provides for accounting of DTA receipts. Thus the existing capital goods and inputs must be accounted in the accounting form prescribed. The form also provides for a remarks column in case certain remarks are to be entered.

No. At present, manufacture and other operations in a bonded warehouse is allowed only in a Private Bonded Warehouse licensed under Section 58 of the Customs

Act.

No. There is no physical control of a unit licensed under Section 65 and Section 58 of the Customs Act, 1962, on a day to day basis. The unit will be subject to risk based audits.

The audit of units operating under Section 65 would also be based on risk criteria. There is no prescribed frequency for such audit.

Following are the customs document for movement of imported goods on which duty has been deferred to/ from a unit undertaking manufacture and other operations in a bonded warehouse:

(i) Customs Station to Section 65 unit: Bill of entry for warehousing. It is clarified that no separate form is prescribed for movement from Customs station to Section 65 unit as the goods are already accompanied by the Bill of entry for warehousing.

(ii) From another warehouse (non-Section 65) to a Section 65 Unit: Form for transfer of goods from a warehouse as prescribed under the Warehoused Goods (Removal) Regulations, 2016. This is because warehouse which is not a Section 65 unit has to follow the Warehoused Goods (Removal) Regulations, 2016.

(iii) From Section 65 Unit to another warehouse (the other warehouse can be a Section 65 unit or a non-Section 65 warehouse): Form prescribed in Manufacture and Other Operations in Warehouse (no. 2) Regulations, 2019.

The goods will not be under customs escort during movement.

The license and permission granted is valid unless it is cancelled or surrendered, or the license issued under Section 58 is cancelled or surrendered. Thus no renewal of the license under Section 58 or permission under Section 65 is required.

A unit licensed under Sections 58 and 65 can import capital goods and warehouse them without payment of duty. Manufacture and other operations in a bonded warehouse is a duty deferment scheme. Thus, both BCD and IGST on imports stand deferred. In the case of capital goods, the import duties (both BCD and IGST) stand deferred till they are cleared from the warehouse for home consumption or are exported.

The capital goods can be cleared for home consumption as per Section 68 read with Section 61 of the Customs Act on payment of applicable duty without interest. The capital goods can also be exported after use, without payment of duty as per Section 69 of the Customs Act. The duty deferment is without any time limitation.

The payment of duty on the finished goods is clarified in Paras 8 and 9 of the Circular No. 34/2019. Duty on the capital goods would be payable if the capital goods itself are cleared into the domestic market (home consumption). Thus, the duty on the capital goods does not get incorporated on the finished goods. Thus, no extra duty on finished goods cleared into DTA is payable on account of imported capital goods (on which duty has been deferred).

Since the unit operating under Section 65 is also licensed as a Private Bonded warehouse under Section 58 of the Customs Act, the procedure for surrender of licence will be as per the regulation 8 of the Private Warehouse Licensing Regulations, 2016. A licensee may therefore, surrender the licence granted to him by making a request in writing to the Principal Commissioner of Customs or Commissioner of Customs, as

the case may be. On receipt of such request, the licence will be cancelled subject to payment of all dues and clearance of remaining goods in such warehouse.

Other related schemes that may help you :

- EPCG – Export Promotion of Capital Goods

- Specialties of Special Economic Zones (SEZ)

- Why should you get an AEO certification today?

Bizbrains provides various assistance and help exporters and manufacturers grow their businesses with various incentives and export process which are cumbersome. Start with us today to get your business to new level.

For more content and updates follow us on LinkedIn, Twitter and Facebook; our handle is Bizbrains Advisors. Get a heads up on various schemes on export-import activity and let us know your thoughts in comment section!

2 Responses

Goods Re-exported from bonded ware house will comes under MTT or normal export???

Case A: If good were imported by person X and stored in bonded ware house after re packaging again goods were exported to another country by the same importer then this transaction comes under which category

Case B: if goods were imported by person X and stored in bonded ware house ,goods were sold to another person Y and after re packaging of goods were re-exported to another country then this transaction comes under which category

2.while re exporting concerned person will pay export duty or not????

3.RODTEP will applicable or not???

Kindly if possible reply with Custom/GST/DGFT notifications.