There was a recent news about India deliberating trade agreement with the European Union. It is important to know about FTA if you are trading back and forth from participating countries as it helps seamless trades between countries and indirectly affects merchants.

This time let's dive into some of the significant amendments that are being made in the light of the situation.

FTA’s (Free Trade Agreements), an overview

A free trade agreement is a pact between two or more nations to reduce barriers to imports and exports among them. Under a free trade policy, goods and services can be bought and sold across international borders with little or no government tariffs, quotas, subsidies or prohibitions.

In modern times, particularly after World War-II, countries collaborated and created the General Agreement on Tariffs and Trade (GATT) on a multilateral platform, which even today acts as a guiding document for finalizing trade deals. Art XXIV of GATT enables WTO members to enter into free trade agreements, in which they offer each other tariff and non-tariff concessions on a reciprocal and mutually beneficial basis. As per WTO’s statistics, there are 339 regional trade agreements in force as on 1 February 2021, and majority of the world international trade takes place under these agreements.

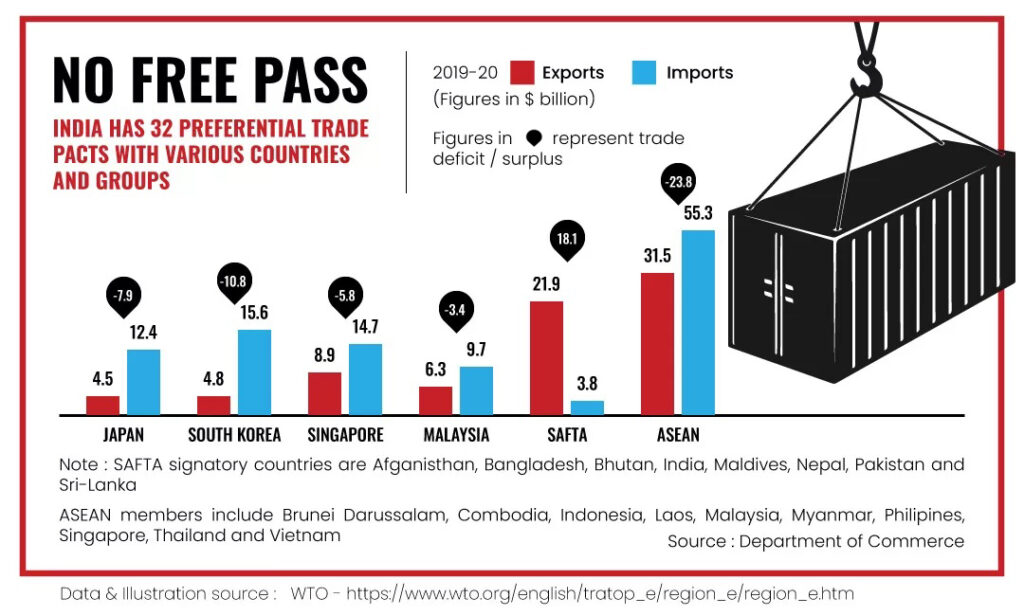

India and FTA at a glimpse:

The image below will give an idea about India’s trade relation with different countries and regions.

The earliest agreement is the treaty on trade with Nepal signed in 1950, which has been subsequently reviewed from time to time. ASEAN-India FTA, Agreement on SAFTA, India-Japan CEPA and India-South Korea CEPA are among the most widely used trade agreements of India. Trade agreements vary in degree of spread and depth, depending upon the nature of markets engaged in negotiations and their respective priorities. While Preferential Trade Agreements (PTAs) could be limited to ‘margin of preference’, i.e. partial exemption of duties on certain tariff lines, comprehensive agreements go deep into tariff concessions providing almost full exemption of customs duties on majority of tariff lines, in addition to touching upon a host of other non-tariff preference areas such as sanitary and phytosanitary measures, technical barriers to trade, quantitative restrictions, import licensing, intellectual property rights, trade facilitation, trade remedies, trade in services, investments etc.

**The image has been taken from CAROTAR 8th October, 2020

Compliance and procedures in FTA

Department of Commerce is the nodal point in the Government of India to negotiate and finalize trade agreements. Central Board of Indirect Taxes and Customs (CBIC), being the main implementation body, plays a crucial role in trade negotiations on issues such as tariff concessions, rules of origin, customs facilitation and IPR.

Once a trade agreement is finalized, CBIC issues notifications for implementing tariff concessions and rules of origin, under section 25 of the Customs Act,1962 and section 5 of the Customs Tariff Act,1975 respectively, in order to incorporate the commitments undertaken in domestic legislation.

Rules of Origin – what do they mean and why are they important

Under a trade agreement, duty concessions are required to be extended only to such imported goods which are ‘made in’ the exporting country. Each FTA contains a set of rules of origin, which prescribe the criteria that must be fulfilled for goods to attain ‘originating status’ in the exporting country.

Therefore, the goods imported under a trade agreement are required to be covered under a Preferential ‘Certificate Of Origin’ (hereinafter referred to as “COO”) issued by the designated authority of the exporting country. The COO contains details of goods covered and originating criterion fulfilled.

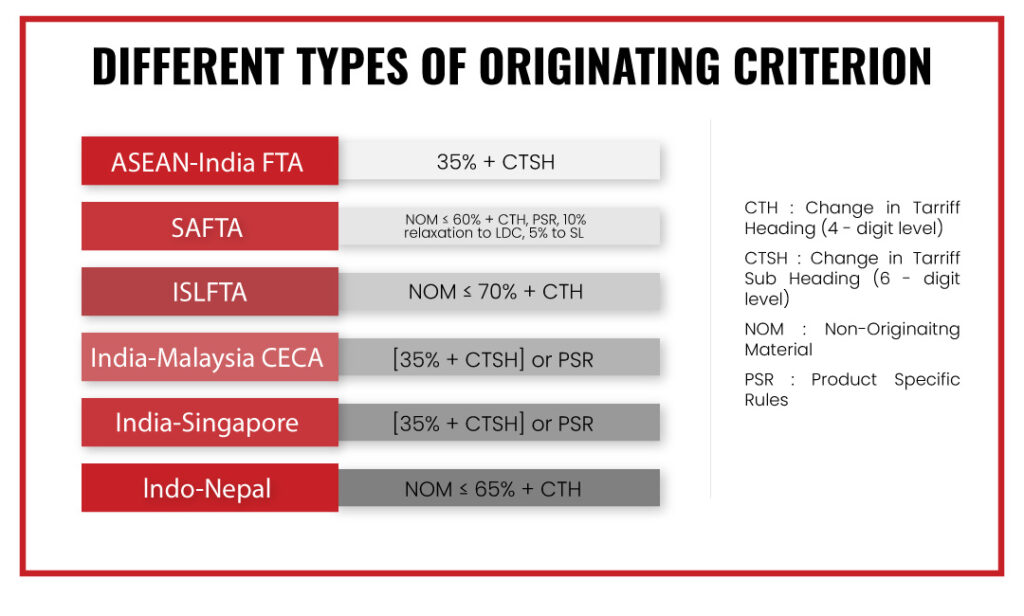

Illustrative image below will explain the criterion that will satisfy the Rules of Origin:

Rules of Origin were created to prevent the misuse of benefits offered to Indian exporters and guarantee safety to Indian manufacturers.

Section 28DA in the Customs Act,1962, therefore, empowers an importer to possess sufficient origin related information. The first point of query into origin of goods wherein preferential tariff treatment has been sought will now be an importer, shifting from G2G to B2G model.

Operational Certification Procedures (OCPs):

Following procedures are generally found in a trade agreement:

- Countries party to a trade agreement designate one or more authority(ies) for issuing COO.

- Exporter intending to claim FTA benefit applies for COO to the designated Issuing Authority.

- Exporter’s application for COO should be supported by relevant documents to demonstrate that the originating criteria claimed by him are duly met.

- The Issuing Authority issues COO in the form and manner prescribed in the trade agreement.

- Exporter sends the original copy of COO to the importer in the importing country. Some FTAs allow use of electronic COO.

- Importer produces the COO to customs during import clearance of goods.

- Where customs officer has a doubt on genuineness/authenticity of the COO or on the accuracy of the information contained therein, he sends a verification request to the designated authority in the exporting country through a nodal officer in the importing country.

It is imperative understand the essence of CAROTAR 2020 to avoid falling flat at the time or before import of goods into India. To make the process of claiming customs duty benefit under respective FTA/PTA prima-facie understanding of CAROTAR is a must, which is explained here below.

CAROTAR (Customs Administration of Rules of Origin under Trade Agreements Rules), 2020

Key Features:

- The extent of information expected to be possessed by an importer is defined.

- Importer is required to keep origin related information specific to each BE for minimum five years from date of filing B/E.

- Mandates inclusion of specific origin related information in B/E.

- Provides for scenario wherein verification from exporting country can be initiated.

- Sets timelines for receiving information from verifying authorities where same is not provided in Trade Agreements.

- Sets timelines for finalising decision based on information received from importer/verifying authorities.

- Action which may be taken on import of identical goods, when it is determined that goods do not meet originating criteria.

Customs are now stricter and hence navigating through rules is imperative to avail the maximum benefits of the available schemes.

With new rules and regulations comes new questions and confusions. Therefore, to resolve any such questions/confusions about CAROTAR & import under any trade agreements at concessional rate, we Bizbrains Advisors have a team of experts at your disposal.

Other related articles that will help you with new FTP 2021-2026:

- DEPC – Export from your district

- RoDTEP Claim Process

- DFIA – Duty Free Import Authorisation : A duty exemption scheme

Bizbrains provides various assistance and help exporters and manufacturers grow their businesses with various incentives and export process which are cumbersome. Start with us today to get your business to new level.

For more content and updates follow us on LinkedIn, Twitter and Facebook; our handle is Bizbrains Advisors. Get a heads up on various schemes on export-import activity and let us know your thoughts in comment section!