EXIM INCENTIVES COMPLIANCE REVIEW

EXIM INCENTIVES COMPLIANCE REVIEW

Incentives announced by the Government come with the accountability to comply with the terms and conditions attached thereto. Non-compliance or partial compliance with the conditions attached to incentives availed leads to the denial of incentives and interest / penal provisions may also become applicable.

Due to the lack of awareness and well trained manpower, compliances relating to incentives are usually not done in a timely manner which leads to businesses paying additional interest and penalty. In addition, due to the non-compliance or incomplete compliances, other future incentives may be denied by the government till the time compliances are completed.

To effectively counter we offer customised solutions like:

- Physical review of various incentives

- Review of documents associated with incentives

- Gap analysis

- Performance report

In addition to the above mentioned services, we also specialize in Import Consultancy – well versed as an Import Advisor to a variety of industries in the country.

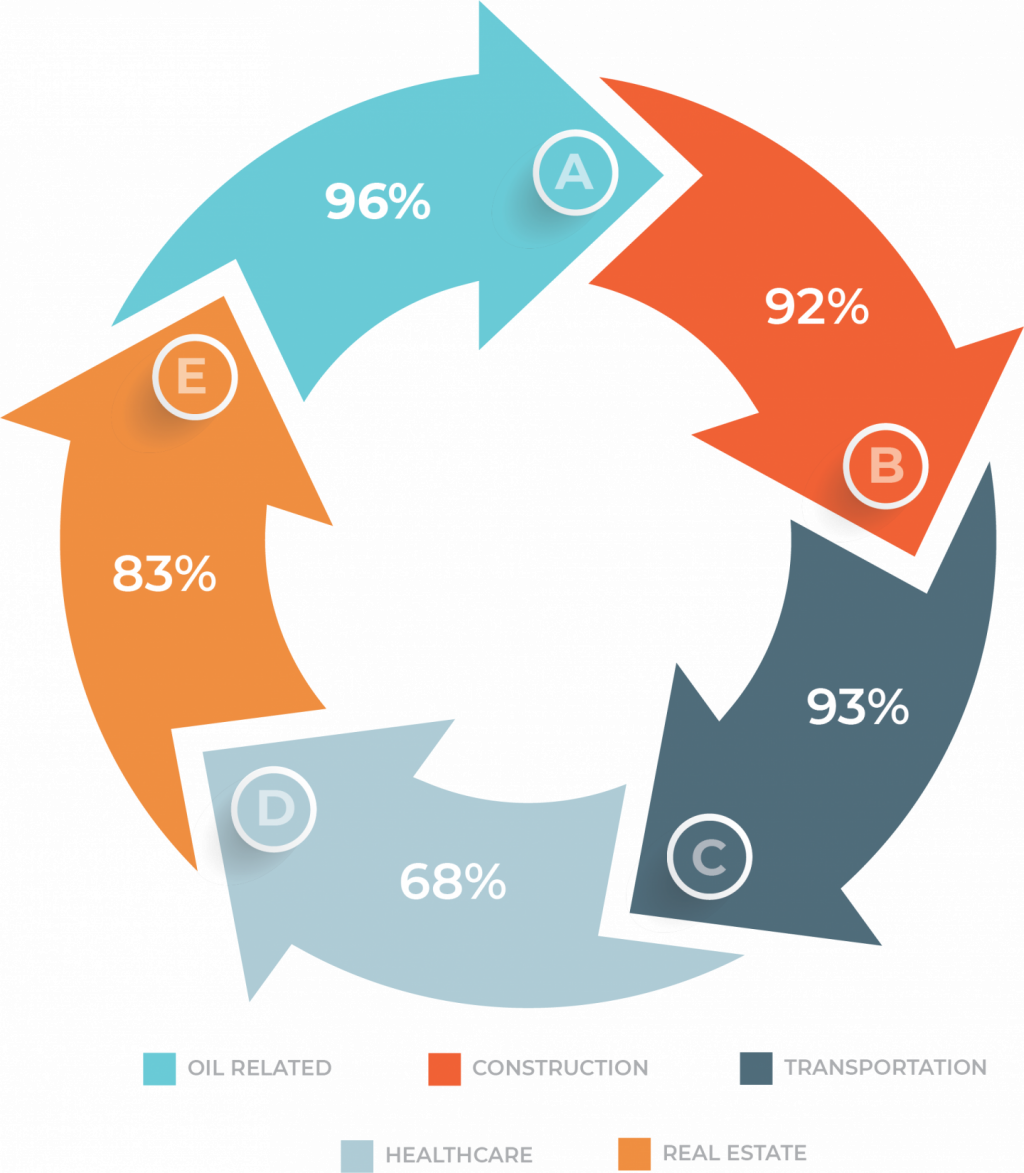

How It Works ?

We continue to pursue that same vision in today’s complex, uncertain world, working every day to earn our customers’ trust! During that time, we’ve become expert in freight transportation by air and all its related services. We work closely with all major around the world. We’ll ask you when the freight is available, what the required delivery date is, and if there’s potential to save on time or cost.

We have more than twenty years of experience. During that time, we’ve become expert in freight transportation by air and all its related services. We work closely with all major airlines around the world. Ongoing negotiations ensure that we always have the cargo space we need and offer you competitive rates.

- First & Reliable

- Tracking Service

- Worldwide Service

- B2B Exchange

- Transparent Pricing

- 20/5 Support

Why Us ?

Quality Control

Professional Staff

FAQ's

Far far away, behind the word mountains, far from the countries Vokalia and Consonantia, there live the blind texts. Separated they live in Bookmarksgrove right at the coast.

The MOOWR scheme stands for Manufacturing and Other Operations in Warehouse Regulations. It allows businesses to defer customs duties on imported goods (including inputs and capital goods) used for manufacturing or other operations within a bonded warehouse.

Any business, whether new or existing, can apply for the MOOWR scheme if they intend to import goods without upfront payment of customs duty and use them in a bonded warehouse for manufacturing or other operations.

Key benefits include deferred customs duty on imported goods, no minimum investment requirement, no export obligation, perpetual license validity, and simplified compliance requirements.

No, there is no minimum investment requirement for the MOOWR scheme, making it accessible to businesses of all sizes, including MSMEs.

The scheme allows for manufacturing, re-labelling, re-packing, sorting, grading, testing, and repair operations within a bonded warehouse.

Customs duty on imported goods is deferred until the goods are cleared from the bonded warehouse. If the finished goods are exported, the duty is fully remitted.

Yes, goods can be cleared for domestic use, but the deferred customs duty and applicable GST must be paid at the time of clearance.

Case Studies

Top secrets about Export Pricing!

Lets embrace this new normal and equip ourselves with knowledge to emerge stronger and better. We hereby share some top secrets on EXPORT PRICING which can be helpful in winning the deal – # Identifying correct HSN codes for your products Applying incorrect HSN codes would lead to availing wrong set of benefits and even […]

Top secrets about Export Pricing!

Lets embrace this new normal and equip ourselves with knowledge to emerge stronger and better. We hereby share some top secrets on EXPORT PRICING which can be helpful in winning the deal – # Identifying correct HSN codes for your products Applying incorrect HSN codes would lead to availing wrong set of benefits and even […]

Top secrets about Export Pricing!

Lets embrace this new normal and equip ourselves with knowledge to emerge stronger and better. We hereby share some top secrets on EXPORT PRICING which can be helpful in winning the deal – # Identifying correct HSN codes for your products Applying incorrect HSN codes would lead to availing wrong set of benefits and even […]