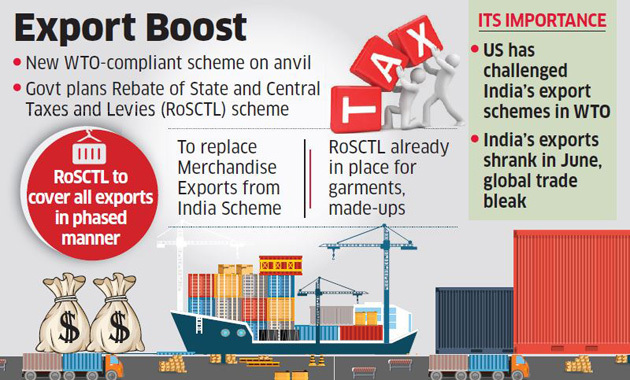

In wake of complaints filed by USA against India to discontinue export incentive scheme (like MEIS), which is not in compliance with WTO guidelines, Commerce ministry has proposed new scheme- Rebate of State & Central Taxes and Levies Scheme (RoSCTL). Currently this scheme is available for Textile industry, however, it would be soon extended to other sectors as well. Let us understand in brief, about RoSCTL scheme which is currently available for Textile industry.

# What is rebate of state and central levy scheme?

Scheme to rebate all embedded State and Central Taxes/levies for meant for exports of made-up articles & garments. However, this scheme is likely to be extended to other export products as well. Also this scheme is in compliance with WTO guidelines.

# In which form the benefit will be given?

Under the RoSCTL, the benefit to exporters shall be given by DGFT in the form of duty credit scrips like Merchandise Exports from India Scheme (MEIS). RoSL (old scheme) are to be processed for shipping bills with Let Export Order (LEO) date upto 6th March, 2019 only.

# What are the State and Central Levies and Taxes which are yet not refunded by the Government in the Duty Drawback Scheme and covered under RoSCTL Scheme?

The Rebate of State Taxes and Levies stand for – VAT on transportation fuel, Captive Power, Mandi Tax, Electricity Duty, Stamp Duty on all the Export Documents, SGST which is levied on inputs of production of cotton (raw) like fertilizers, pesticides, etc., any kind of purchases which are made from unregistered dealers, inputs which are needed for the Transport Sector, Coal which is used in the production.

The Rebate of Central Taxes and Levies stand for Central Excise Duty on Transportation Fuel, CGST included on all kinds of paid inputs like pesticides, fertilizers, etc., any kind of purchases which are made from unregistered dealers, inputs which are needed for the Transport Sector, Finally, the CGST and Compensation Cess on Coal which is used for the production of electricity.

# For which business export this scheme is applicable?

Currently, RoSCTL is available on garment exports to exports of made-up articles

# Till when this notification will remain in effect?

The RoSCTL has come into force from 07.03.2019 and will remain in effect till 31st March 2020.

# What are the rates of rebate under RoSCTL?

Rate for rebate under RoSCTL are provided at this link.

Different schedules under which rates are explained here below:

Schedule-1 Rates of State taxes and levies are the rates of State levies, for apparel and made-ups.

Schedule-2 Rates of embedded Central leviesare the rates of Central levies, for apparel and made-ups.

Schedule-3 Rates AA State taxes and levies are the rates of State and Central taxes, applicable for apparel exports when the fabric (including interlining) only has been imported duty free under Special Advance Authorization Scheme.

Schedule-4 Rates of AA embedded Central levies are the rates of embedded Central levies applicable for apparel exports when the fabric (including interlining) only has been imported duty free under Special Advance Authorization Scheme.

- The earlier RoSL scheme for garments and made-ups has been discontinued w.e.f. 7th March, 2019

# Recommendations –

Exporters should keep a close watch on the new export incentives schemes announced by the Commerce Ministry and take necessary actions to avail benefit under the scheme.

To know further about EXIM related matters, feel free to get in touch with us through e-mail id – info@bizbrains.in or at +91 (79) 4890 7720 / (+91) 94280 79020.

Have you claimed all your eligible Export incentives/refunds? Don’t worry, we are here to help you. For further details visit our page