Rules of origin are the criteria needed to determine the national source of a product. Their importance is derived from the fact that duties and restrictions in several cases depend upon the source of imports.

There have been major changes in the Rules of Origin (ROO) on 21st September to curb the misuse of the agreements that are hurting the domestic industry.

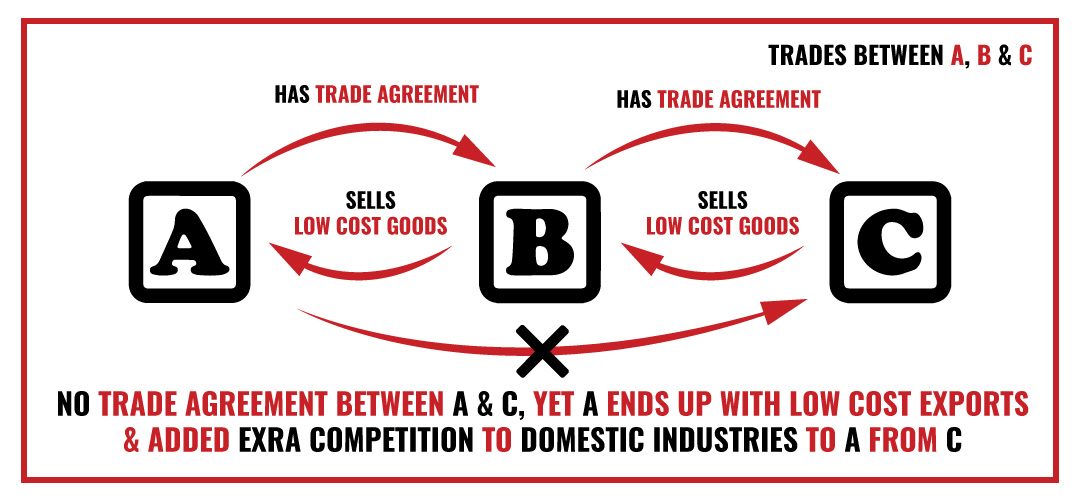

But how ROO can be misused? To understand let us go through in depth analysis with an example.

Let’s take an Example…

Consider three countries, Country A, Country B and Country C. Country A has a trade agreement with Country B, Country B has an agreement with Country C but Country A has no agreement with Country C. Country C exports items to Country B under the trade agreement at low costs; the goods further get exported to Country A via. Country B and again due to the trade agreement the cost of goods remains low. What do we learn from this?

# Rules of Origin in India :

The practice has been rampant in India in electronic items like mobile, TV’s, set-top box, air conditioners, electronic parts and telecom equipment. and hence, the new Rules of Origin.

The new Rules of Origin. They are now called ‘The Customs Rules, 2020’ which will take some time to replace the name ‘Rules of Origin’ just as it is difficult to replace the new year in date section for the first week of January. They shall apply to import of goods into India where the importer makes claim of preferential rate of duty in terms of a trade agreement.

DEFINITIONS:

- In these rules, unless the context otherwise requires –

- “Act” means the Customs Act, 1962 (52 of 1962).

- “Preferential rate of duty” means rate at which customs duty is charged in accordance with a trade agreement.

- “Preferential tariff treatment” means allowing preferential rate of duty to goods imported into India in accordance with a trade agreement.

- “Rules of Origin” means rules notified for a trade agreement in terms of sub-section (1) of section 5 of the Customs Tariff Act, 1975 (51 of 1975).

- “Tariff notification” means notification issued under sub-section (1) of section 25 of the Act specifying preferential rates of customs duty in accordance with a trade agreement.

- “Verification” means verifying genuineness of a certificate of origin or correctness of the information contained therein in the manner prescribed by the respective Rules of Origin.

- “Verification Authority” means the authority in exporting country or country of origin, designated to respond to verification request under a trade agreement.

# How does the Preferential claim work?

To claim preferential rate of duty under a trade agreement, the importer or his agent shall, at the time of filing bill of entry

- Make a declaration in the bill of entry that the goods qualify as originating goods for preferential rate of duty under that agreement;

- Indicate in the bill of entry the respective tariff notification against each item on which preferential rate of duty is claimed;

- Produce certificate of origin covering each item on which preferential rate of duty is claimed; and

- Enter details of certificate of origin in the bill of entry, namely:

- Certificate of origin reference number;

- Date of issuance of certificate of origin;

- Originating criteria;

- Indicate if accumulation / cumulation is applied;

- Indicate if the certificate of origin is issued by a third country (back-to-back); and

- Indicate if goods have been transported directly from country of origin.

Notwithstanding anything contained in these rules, the claim of preferential rate of duty may be denied by the proper officer without verification if the certificate of origin –

- Is incomplete and not in accordance with the format as prescribed by the Rules of Origin;

- Has any alteration not authenticated by the Issuing Authority;

- Is produced after its validity period has expired; or

- Is issued for an item which is not eligible for preferential tariff treatment under the trade agreement;

and in all such cases, the certificate shall be marked as “INAPPLICABLE”.

# Origin related information to be possessed by importer

The importer claiming preferential rate of duty shall –

- Possess information to demonstrate the manner in which country of origin criteria, including the regional value content and product specific criteria, specified in the Rules of Origin, are satisfied, and submit the same to the proper officer on request.

- Keep all supporting documents related to Form I for at least five years from date of filing of bill of entry and submit the same to the proper officer on request.

- Exercise reasonable care to ensure the accuracy and truthfulness of the aforesaid information and documents.

If the concerned officer is not satisfied with the documents provided by the importer, he can ask him to re-furnish the documents within 10 days, failure of which can lead to the disallowing the claim of preferential duty.

Points to Remember:

We understand that the plethora of conditions and rules mentioned along with complex definitions are difficult to comprehend all at once. Hence, we at Bizbrains are always available to resolve your queries and doubts, however big or small

For more content and updates follow us on LinkedIn, Twitter and Facebook; our handle is Bizbrains Advisors. Get a heads up on various schemes on export-import activity and let us know your thoughts in comment section!

Pingback: RoDTEP just 3 months away – Are you Ready?

Pingback: RoDTEP Claim Process